Chief Operating Officer, Nissan Motor Co., Ltd

Fiscal Year 2010 First Half Results Press conference

Nissan's performance in the first half of fiscal year 2010 has produced better-than-expected results. We have kept our focus on executing our recovery plan, and we have been quick to take advantage of opportunities for profitable growth. Due to these actions and to higher sales in all regions, Nissan's performance is solidly on track.

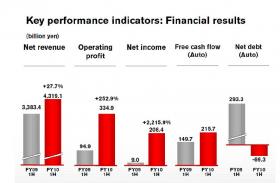

For the first half of fiscal year 2010, we are reporting consolidated net revenues of 4.3 trillion yen and operating profit of 334.9 billion yen, yielding an operating margin of 7.8%, and net income of 208.4 billion yen. Free cash flow for the auto business totaled a positive 215.7 billion yen - as a result automotive net debt has been eliminated and we have transitioned to a automotive net cash position in the amount of 69.3 billion yen.

Looking forward to the second half of this fiscal year, we recognize headwinds in the macro environment that are beyond our control, including risks associated with the appreciation of the Japanese yen, the possibility of higher raw material costs and the ongoing uncertainty about the pace of the global economic recovery. Even so, our current strong business momentum, as a result of the execution of our recovery plan, is trending in the right direction - leading us to revise our forecast for fiscal 2010 upward.

FY10 first-half business update

As I review our business performance in the first half, let me begin with a brief update on recent business activities.

First, we continue to move forward with activities that promote sustainable mobility mainly through our PURE DRIVE and zero-emission vehicles.

PURE DRIVE cars are designed to achieve class-leading fuel economy with next-generation eco-technologies, and we are launching a series of PURE DRIVE cars this year. The first - the new March - features Idling Stop technology. The second in the series - Clean Diesel X-TRAIL with automatic transmission - complies with the world's most stringent emission standards.

We also made further concrete steps toward the launch of our first all-electric car, Nissan LEAF.

At this point, we have established more than 80 partnerships with governments and municipalities around the world, preparing the way for the launch of electric cars. We started the construction of our EV battery plants in Europe and the U.S. We are now installing two standard chargers at all our dealerships in Japan - a total of 4,400 chargers - and Nissan-developed quick chargers at approximately 200 of those dealerships. And demand for Nissan LEAF has been robust in Japan and the U.S., where sales will begin in December.

Our zero-emission strategy is on track.

Including Nissan LEAF, we are launching 10 all-new models in this fiscal year. Our latest new-model launches have included:

- the Juke compact sports crossover in Japan and Europe;

- the new March/Micra compact car in Japan, India and China;

- the Elgrand premier luxury minivan in Japan; and

- the Infiniti QX luxury full-size SUV in the United States, Europe and the Middle East.

Another important event from the first half was the start of a wide-ranging strategic cooperation between the Renault-Nissan Alliance and Daimler. Several projects are now under way, covering new product development, powertrain sharing and synergy opportunities.

FY10 first-half sales performance

Looking at Nissan's global sales during the first half, I will begin with a review of the global total industry volume, which increased 14.5% compared to the year-ago level. This growth resulted from increased demand across many markets around the world and particularly strong demand in China. Among the mature markets, only Europe showed a decline.

For the first half, Nissan sales totaled 2 million 9 thousand units, a 23.8% increase compared with the same period last year. Our sales increased in every region.

In Japan, the total industry volume increased 16.8%, to 2.5 million units. Our sales increased 15.3% over the prior-year level, to 328,000 units. Although Nissan's market share decreased two-tenths of a percent, we launched three new models, and each has seen a strong start in sales.

In North America, Nissan's sales increased in the United States, Canada and Mexico. In the United States, the total industry volume in the first half increased 8.3%, to 6.1 million units, and our first-half sales were up 9.8% over the prior-year level, and our market share increased to 7.3%. Our sales in Mexico were up 28.6%, and our market share improved 2.9 percentage points, resulting in a 23% share of the Mexican car market.

In Europe, the total industry volume was 8.9 million units, down 3.5%, due to sluggish demand in main markets, such as Germany. However, Nissan sales were up 12.6%, to 277,000 units. Our market share increased four-tenths of a percent, to 3.1%. In Russia, our sales have rebounded, increasing 38.9% to 42,600 units.

In China, where the total industry volume increased 45.6% compared to the prior year, our sales increased 51.4% from January to June, to 503,000 units. Nissan's sales were boosted by sales of Sylphy, QASHQAI and Teana. Our market share in China rose two-tenths of a percent, to 6.1%.

In other markets, including Asia, Africa, South America and the Middle East, our sales volume increased 32.9%, to 321,000 units. Our volume in Thailand was boosted by strong sales of March, the first model offered for sale under the country's government-approved "eco-car" program.

FY10 first-half financial results

Our financial results for the first half of fiscal 2010 continue to be supported by the three pillars of the recovery plan - revenue growth, tight cost management and free cash flow generation.

Consolidated net revenues have increased 27.7%, to 4 trillion 319.1 billion yen. The main contributor - increased volume - was slightly offset by the negative impact from foreign exchange.

Consolidated operating profit totaled a positive 334.9 billion yen, a 7.8% operating margin.

Net income was also positive, at 208.4 billion yen, which was a net margin of 4.8%.

Explaining the operating profit variance analysis versus the comparable FY2009 period:

- The 55.2 billion yen negative impact from foreign exchange came from the appreciation of the yen. The majority of this variance was due to the 52.4 billion yen impact of the U.S. dollar.

- The net impact of purchasing cost reduction was a positive 53.4 billion yen, which included a 27.4 billion yen negative impact from energy and raw material costs.

- Volume and mix produced a positive impact of 299.3 billion yen as a result of the increase in global sales volume.

- Selling expenses had a negative impact of 93.2 billion yen due to the increase in volumes and the normalization of fixed expenses, such as advertising.

- Lower gains on the resale of returned lease vehicles in North America resulted in a negative variance of 13.5 billion yen.

- R&D costs increased 17.9 billion yen.

- Sales financing contributed a positive 14.8 billion yen. This was due to improved borrowing costs and lower net loss provisions for the period.

- The remaining variance was a positive 52.3 billion yen, due mainly to improved profitability from affiliate companies and savings of fixed expenses.

At the end of the first half, our net automotive debt had been entirely eliminated and we moved to a net cash position in the amount of 69.3 billion yen, which was a significant improvement from the year-ago level. If the yen had remained at the exchange rates that existed at the start of this fiscal year, our cash position would have come to 156.3 billion yen.

Since the start of the global financial crisis in fiscal 2008, we have taken disciplined actions to tighten our control of inventory. From its peak in November 2008 at 720,000 units, our global inventory now stands at 570,000 units, rising from the end of the first quarter as sales volumes have increased. Our overall days' supply remains lean, and we continue to monitor the balance of sales, inventory and production carefully.

FY10 outlook

Our first-half results demonstrate that Nissan is managing its business effectively. We are expanding our sales profitably, and we are keeping a diligent focus on cost reduction and efficiency improvement.

We expect that our second-half performance will not be at the same level as the first half due to external factors such as exchange rate volatility and the potential for higher raw material prices. We are also taking into account planned higher engineering expenses and increased costs associated with launching a higher number of new models - more than double what we launched in the first half - through the end of the fiscal year.

In the global auto industry, we are seeing signs of stabilization and growth. With a TIV assumption of 70 million units for the full year - an 8.6% increase year-on-year and a record level in the global auto industry - we expect Nissan's global sales to reach 4.1 million units, up 16.7% compared with the prior year. Our market share is expected to rise from 5.5% to 5.8%.

Our global production volume is forecast to be 4.05 million units.

Considering the contributions we are seeing from growth and ongoing efficiencies and risks we foresee for the remainder of the year, we have filed a revised full-year forecast with the Tokyo Stock Exchange, using a foreign exchange rate assumption of 80 yen to the dollar and 110 yen to the euro for the second half.

- Net revenue is expected to be 8.77 trillion yen.

- Operating profit is expected to be 485 billion yen.

- Net income is forecast to be 270 billion yen.

- Capital expenditures are expected to reach 340 billion yen.

- R&D expenses will amount to 425 billion yen.

Explaining the operating profit variance analysis compared with last year:

- The appreciation in the yen is expected to have a negative foreign exchange impact of 185 billion yen.

- Due to the increase in sales, volume and mix are estimated to have a positive impact of 475 billion yen.

- Raw materials are expected to increase by 100 billion yen; however, purchasing cost-reduction efforts are expected to contribute a positive 185 billion yen.

- Marketing and Sales expenses are expected to rise by 180 billion yen.

- Lower gains on the resale of returned lease vehicles in North America are expected to be 20 billion yen.

- R&D cost is estimated to increase 40 billion yen.

- Others, including the profit from affiliate companies, are expected to amount to a positive 38.4 billion yen.

Consistent with the dividend plan we announced in May, an interim dividend of 5 yen will be paid in November.

Even as the strength of the Japanese yen continues to have a negative impact on our profitability, I remind you to keep the effect of foreign exchange in the context of our global operations. Our portfolio is becoming increasingly diversified. Our profits come from all the regions where we do business. The products sold in those regions are sourced from various countries, which buffers our exposure to severe fluctuations in forex.

In order to minimize the effect of Japanese yen appreciation on our global business, we will take a balanced approach. We will reduce yen-based costs by optimizing production and cost effectiveness. We also aim to grow our yen-based revenues by increasing our domestic market share to 15% by fiscal year 2013. These actions will strengthen our monozukuri base in Japan and are required to maintain our objective of a minimum one million units of domestic production

In the second half of this fiscal year, seven models remain to be launched, including:

- Nissan LEAF in Japan, the United States and Europe;

- the new Serena minivan and a new mini car in Japan;

- Nissan Quest minivan, a convertible crossover and an NV Series light commercial vehicle in North America; and

- An affordable sedan in other markets.

In addition, the first application of Nissan's original hybrid technology was offered in the new Fuga Hybrid luxury sedan. Fuga Hybrid - third in the series of PURE DRIVE vehicles introduced in Japan this year - offers the fuel economy of a compact car, at 19 kilometers per liter, while providing the feel and exhilarating driving performance of a luxury car. Fuga Hybrid went on sale the day before yesterday.

Our new products and technologies will continue to support our growth. We look forward to giving you an update on the market response to Nissan LEAF after the launch.

Conclusion

We are confident in our ability to meet the challenges ahead while remaining prudent about obstacles in the global operating environment. Our balance sheet is stronger, supporting our ability to invest in our business. We feel positive about our strategies for zero-emission vehicles, global compact cars and emerging marketsc and about our potential for the future. Nissan is well positioned to grow with the right products, the right technologies and the right performance.

print Tweet

Comments

The alliance has done a great job in coming up with the Nissan Leaf, as well as other quality models such as the Juke compact sports crossover, the Micra, Elgrand, and Infiniti QX luxury SUV. Aside from this it has also done a great job in incorporating environment-friendly auto parts in these models. The results have been very impressive to say the least.

Post new comment