The alliance Press kit

-

RNBV: STEERING THE ALLIANCERead

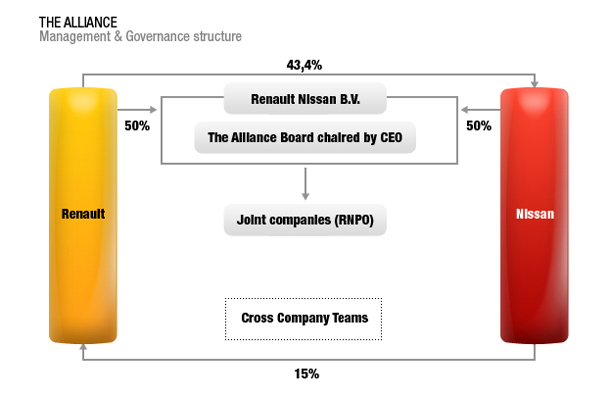

Renault-Nissan BV (RNBV) is a strategic management company originally created in 2002 to manage areas such as corporate governance between the two companies. Based in Amsterdam, it is owned 50/50 by Renault and Nissan and provides a neutral location for the Alliance to exchange ideas, build strategy and help leverage the maximum synergies between the two companies.

When the financial crisis hit in late 2008, it provided an opportunity to revisit the role of RNBV within the Alliance: After 10 years in existence, the time was right to take the Alliance to a higher level, accelerating synergies between Renault and Nissan.May 2009 saw the creation of an Alliance dedicated team for RNBV which now comprises 16 managing directors and directors who work day-to-day with the Renault and Nissan management.

Key areas covered by the Alliance team are:

• Zero Emission Business

• Global Logistics

• Information Systems/Information Technology

• Purchasing

• Platforms and parts

• Powertrains

• Research and Advanced Technology

• Support functions

• Global Sourcing

• Communications

• Finance

• Battery Business

• Price Entry Vehicle

• Economic Advisory

This team is not a substitute for existing operations; it works with various committees and functions in order to propose and develop synergies that have to be approved by the Alliance Board. Also, if there are conflicts between the two companies, it is expected to provide alternative solutions.

An Alliance managing director is responsible for managing and leading each company’s functions for the Alliance and to be accountable for both companies’ operations in a given area.

The role of the Alliance directors is to act as coordinators and make sure that the work performed by the functions achieves greater synergies; if it doesn’t, they have the authority to stop that work going ahead.

The Alliance gives Renault and Nissan a unique competitive edge in the global auto industry and played a critical role guiding both companies through the 2008/09 economic crisis. The long-term aim remains to deepen the synergies between the two companies and react faster to opportunities and for the mutual benefit of both companies.

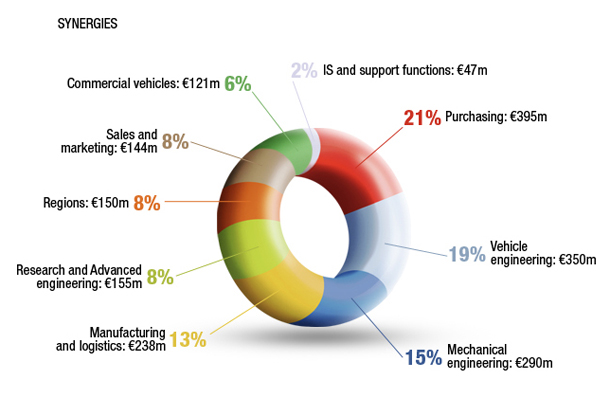

Part of the responsibility of the RNBV team is to help measure the value of the Alliance in terms of synergies - total 2010 synergies are estimated at just over €2 billion of which 50 per cent alone will come from finding new savings.

RNBV also promotes awareness of the Alliance internally and externally. Internally, awareness of the Alliance depends on an employee’s level of responsibility. It means more to some than to others. RNBV helps by promoting the Alliance in a certain field and explain to all, not just a few, employees that this is a unique tool. Externally, the Alliance is known by shareholders, analysts and the media but to most customers and the public in general it is relatively unknown.

-

ZERO EMISSION MOBILITYRead

The Renault-Nissan Alliance aims to be the leader of zero emission mobility - to get there it has already committed €4 billion into its electric vehicle (EV) and battery development programs and has over 2,000 engineers working on these projects.

The way the Alliance is approaching zero emission mobility is unique - the Alliance is putting in place a system that involves it in every aspect of the EV experience.

The Alliance will launch the first zero emission car in late 2010 - the Nissan LEAF which has already received more than 6,000 advanced orders in Japan and around 14,000 in the U.S. Nissan and Infiniti will launch four EVs, including the LEAF; Renault will launch four EVs starting with the Fluence and Kangoo in the first half of 2011 followed by Twizzy in second half of 2011 and Zoe in the first half of 2012.

The Alliance will launch the first zero emission car in late 2010 - the Nissan LEAF which has already received more than 6,000 advanced orders in Japan and around 14,000 in the U.S. Nissan and Infiniti will launch four EVs, including the LEAF; Renault will launch four EVs starting with the Fluence and Kangoo in the first half of 2011 followed by Twizzy in second half of 2011 and Zoe in the first half of 2012.In May 2008, as part of the Alliance’s zero emission strategy, Nissan and NEC formed a joint-venture company, Automotive Energy Supply Corporation (AESC) to focus on the development and mass production of advanced lithium-ion batteries for a wide range of automotive applications from hybrids, electric vehicles to fuel-cell vehicles. AESC began production in 2009 at its facility at Nissan’s Zama plant in Kanagawa Prefecture where annual capacity is 65,000 units. Globally, Alliance battery production capacity will be 500,000 units a year by the end of 2013.

AESC will market its battery products to potential customers in the automotive industry worldwide; it has also been appointed as a supplier of li-ion batteries to Project Better Place which is partnering the Alliance for the first wide-scale deployment of zero emission vehicles in Israel and Denmark in 2011.

Other Alliance battery production sites, announced in 2009, include France, Portugal, the UK and the U.S.

Over 60 partnerships with public and private organizations have been forged worldwide in order to create the necessary conditions (incentives, infrastructures) for the introduction of electric vehicles. The Alliance benefits from geographical synergies that help maximize the global EV infrastructure and governmental support.

People around the world are increasingly focusing on the threat of global warming and the needs for lower vehicle emissions and independence from oil, and automakers are responding to the need with a variety of technological solutions. The Alliance continues to invest in a portfolio of "green" technologies, including clean diesels, hybrids and fuel cell vehicles. But the centerpiece of product strategy for the next five years will be zero-emission vehicles, beginning with all-electric cars.

"We are preparing a car that will be neutral to the environment - transportation without guilt over the environment," said Carlos Ghosn Chairman and CEO of the Renault-Nissan Alliance. "We are emphasizing zero emissions. It’s a territory we want to own, and we are taking all the initiatives necessary to make it happen."

Why has the Alliance committed itself to leadership in electric vehicles ahead of hybrids or other alternative forms of future propulsion? Simply, because EVs are the most mature form of technology that allows it to reach zero emissions. The technology, even as it exists today will be more than ample for most drivers, although there will need to be a change in mindset to conquer what is now being called ‘range anxiety’.

The battery in the Nissan LEAF is already good for 160km a day between charges (based on the LA92 urban driving cycle), far more than the daily needs of 80 per cent of motorists around the world. Beyond the comparison with alternative forms of propulsion, when customers realise that EVs can save them money on running costs; they don’t ever need to visit a filling station, are fun to drive thanks to "on-demand torque" and a very low centre-of-gravity; and are silent; the Alliance believes the market will tip in the same way that the market for diesel cars tipped in Europe 15 years ago.

The battery in the Nissan LEAF is already good for 160km a day between charges (based on the LA92 urban driving cycle), far more than the daily needs of 80 per cent of motorists around the world. Beyond the comparison with alternative forms of propulsion, when customers realise that EVs can save them money on running costs; they don’t ever need to visit a filling station, are fun to drive thanks to "on-demand torque" and a very low centre-of-gravity; and are silent; the Alliance believes the market will tip in the same way that the market for diesel cars tipped in Europe 15 years ago.European initiatives

The Alliance is playing its part in helping develop breakthrough electric vehicle technologies, joining two European Union initiatives. The first is called EVA which aims to accelerate the market introduction of electric vehicles in a coordinated manner. The other is RELIBAT which is investigating the recycling and re-use of automotive lithium-based batteries. EVA is a four-year €41 million project involving 21 cities and regions. RELIBAT brings together eight of the leading European recycling companies, R&D laboratories, automakers and battery manufacturers. The project’s objective is to develop methods for the re-use, recycling and recovery of end-of-life car lithium-based batteries.

-

STRATEGIC COOPERATION WITH DAIMLERRead

More than 11 years have passed since Renault and Nissan ‘took a gamble’ on each other to form the Alliance. It has proved successful and the Alliance continues to evolve with the announcement on April 7th, 2010 of a broad strategic co-operation with Daimler that covers a wide range of projects as well as sharing of best practices.

Projects include Renault and Daimler working together on next generation small cars: the Renault Twingo and smart fortwo, including electric versions as well as expanding both model ranges.

There will also be powertrain sharing and co-development on future projects across both passenger cars and light commercial vehicles. The two groups also announced an equity exchange that gives the Renault-Nissan Alliance a 3.1 per cent stake in Daimler and Daimler a combined 3.1 per cent in Renault and Nissan.

Cross-shareholding structure

The Alliance believes there is the need to have greater economies of scale to cover all relevant technologies and to cover global markets including emerging markets. Without the right economies of scale it would be considerably more expensive to offer the full range of EVs, hybrids, diesels and petrol engines required by consumers worldwide. Automakers also need scale to cover a full line-up of products from ultra-low-cost cars to sedans, commercial vehicles, sports cars, luxury and four-by-fours.Renault-Nissan already has significant scale, with more than six million units sold annually making it the fourth-largest automotive group. The co-operation with Daimler builds on that scale and adds complementary skills and technologies making the strategic co-operation a technological powerhouse.

Carlos Ghosn said: "We know how to work successfully in collaborative partnerships, and this experience is extremely valuable in today’s -- and even more tomorrow’s -- global auto industry. This agreement will extend our strategic collaboration and create lasting value for the Renault-Nissan Alliance."

The individual brand identities will remain unaffected. It is called a strategic co-operation because it is more than a co-operation agreement but not a full-blown alliance. It will be managed by Renault-Nissan B.V. for the Alliance and Daimler through a new cooperation committee giving representation to all parties.

It will create a long-term framework to work closely on future areas of co-operation between Renault, Nissan and Daimler. Opportunities already identified include the study of sharing powertrains between Infiniti and Mercedes-Benz vehicles while regional co-operation in the United States, China and Japan between Nissan, Infiniti and Daimler offers more potential.

The launches of the jointly developed small car models are planned for 2013 onwards. The smart plant in Hambach, France, will be the production location for two-seater versions, while the Renault plant in Novo Mesto (Slovenia) will be the production location for the four-seater versions. Future models will also be available with an electric drive from launch. Powertrain sharing will focus on fuel-efficient, diesel and petrol engines.

Including the small car projects, the Renault-Nissan Alliance will provide 3- and 4-cylinder petrol and diesel engines to Daimler out of its portfolio. Daimler will provide current 4- and 6-cylinder petrol and diesel engines to Infiniti.

-

INDIARead

Major Alliance activity in new growth markets recently has been in India with the inauguration of the first dedicated Renault-Nissan Alliance plant in Chennai.

The first vehicle to be produced at the plant is the new Nissan Micra, which is also the first vehicle derived from the new V-platform. The model will be sold in India as well as being exported to over 100 countries in Europe, the Middle East and Africa.

From 2011, the plant will start production of the Renault Koleos and Fluence, both for the Indian market. Renault is planning to bring out several new cars over the next one and a half to two years and will offer a complete range within four years. These vehicles will be manufactured at Chennai. The range will cover the key market segments and comprise both Renault models and cars built with the joint platforms of the Renault-Nissan Alliance, including a crossover.

Chennai is also home to the first Renault Nissan Alliance joint venture Technical Centre, a key milestone in the history of the Alliance.

Chennai was chosen as the location for the first Alliance car plant following negotiations with the Tamil Nadu state government on infrastructure improvements including a new port at Ennore. This new port is north of Chennai and 70km and 2.5 hours by road from the factory.

Chennai was chosen as the location for the first Alliance car plant following negotiations with the Tamil Nadu state government on infrastructure improvements including a new port at Ennore. This new port is north of Chennai and 70km and 2.5 hours by road from the factory.The factory is located in the Oragadam Expansion Scheme and represents an investment of about €800 million over seven years from February 2008 to 2015. The plant will have the capacity to produce 400,000 vehicles a year at full ramp up.

From start to finish the project took 21 months from ground breaking in June 2008. Localization of parts has been a high priority - 85 per cent of suppliers are in India with 50 per cent of these in the state of Tamil Nadu. A supplier site is located next door to the plant at its southern end.

The plant currently employs 1,500 people with an average age of 25. This will grow to 3,000 by 2012. Core training of supervisors was carried out in Japan and at the NMUK plant in Sunderland. This involved sending 250 people to the two locations for 11 weeks of training.

The plant has full stamping, body, paint, plastic, trim and chassis shops with two test tracks, one short for every car as it leaves the production line and a longer 1.5km track which includes different road surfaces.

The engine and chassis plant is sited next to the assembly facility on its south-east boundary. This currently assembles XH gasoline and K9K diesel engines.

The target for the Chennai workforce is to be best-in-class compared to other Indian manufacturers within three years - a year faster than Nissan managed in China.

To reach these global standards, Chennai is being guided by the Alliance Integrated Manufacturing System (AIMS) and the Alliance Production Way which combines Renault-Nissan best practices and benchmarking while also helps to keep costs to a minimum.

The stamping shop at the northern end of the plant uses the first Alliance specification presses and blanking line and is compatible with both Renault and Nissan die specifications.

The line can handle four platforms and eight body styles in random production order. Both sub-assembly and parts supply to the line are totally flexible. Efficiency is improved by having bumper and plastic moldings produced on site while the assembly line boasts a highly efficient logistics layout with a 100 per cent kit supply system to the lineside which saves operators having to pick parts from more than one place reducing the need to walk to collect parts. This is a development of what Nissan does at its Oppama, Japan and Sunderland, UK facilities.

The structure of the Alliance technical center - Renault Nissan Technical and Business Center India PL (RNTBCIPL), based at Mahindra World City, a new business park development about an hour from the centre of Chennai - has separate Renault and Nissan operations but joint purchasing, human resources, finance, information systems and administration.

The Renault team supports powertrain development, vehicle engineering, information systems as well as styling and special project support for Renault's Mumbai-based design studio.

The Nissan team handles information systems, research, manufacturing engineering, vehicle and powertrain development and parts. Synergies are expanding across the functions of the two companies. The centre also provides remote engineering for corporate projects through simulations on such things as crash protection and also research on electronics and embedded software.

Partnership with Bajaj Auto

In November 2009, the Renault-Nissan Alliance confirmed that it was developing a new and innovative four-wheel vehicle in partnership with Bajaj Auto Ltd. The Alliance intends to launch this competitive, fuel-efficient four-wheeler in the Indian market in 2012. On July 8, 2010, the Renault-Nissan Alliance confirmed its plans with Bajaj through the signing of an MOU.

Bajaj is India's second largest maker of two-wheelers and also produces the famous three-wheel autorickshaws that dominate transport across India.

The design, engineering, manufacturing and supply-base expertise to create this all-new product will be executed by Bajaj with the support of the Alliance. The marketing and distribution will be led by the Alliance, with the support of Bajaj.

The project reinforces a key strategic direction taken by the Alliance: accessible mobility for all. In pure volume terms, this represents a vast new consumer segment for the industry. The Bajaj project will help the Alliance to compete effectively and efficiently in the Indian market and also other emerging markets where there is a growing demand for affordable personal transportation.

-

RUSSIARead

The Alliance market share objective in Russia is to expand from 33 per cent to 40 per cent by 2015 with partner AvtoVAZ. AvtoVAZ produced 294,737 vehicles in 2009, of which 34,756 for export. Output target is 900,000 vehicles from the Togliatti plant in 2015, maintaining Lada’s position on the Russian market and developing exports.

With Renault’s 25 per cent shareholding in AvtoVAZ, the Alliance has three plants in Russia at Togliatti, Moscow and St Petersburg and total production capacity will be 1.3 million units by 2012.

AvtoVAZ's Lada brand achieved 29.8 per cent market share in Russia in the first half of 2010, Renault 5.7 per cent and Nissan 3.6 per cent, a total of 39.1 per cent for the three brands combined. The priorities for AvtoVAZ are:• Quality, a vital condition for Lada's revival

• Upgrading the line that will assemble Lada, Renault and Nissan cars, using the Logan platform.

• Introducing the Alliance Production Way at the plant as soon as possible.

There is much to be gained: a three-way alliance covering 40 per cent of what will soon be Europe's biggest market (3.5 to 4 million cars a year forecast for 2015), based on a manufacturing set-up that includes Togliatti, Moscow and St Petersburg, sharing platforms and engines. Russia is set to become one of the new growth pillars for the Alliance in terms of both sales volumes and profitability.

-

MOROCCO, TANGIERSRead

The Tangiers industrial project, first announced in late 2007 and representing a €600 million investment, remains strategic for the Alliance. Given recent economic events, the Alliance has decided to adapt the project, but without abandoning its ambitions for the post-crisis period. Production of vehicles based on the Logan (B0) platform is now scheduled to start in early 2012 with one production line and an annual output capacity of 170,000 vehicles. Ultimately, capacity will be increased to 400,000 vehicles a year as originally planned.

The Tangiers development is one of the largest manufacturing complexes in the Mediterranean.

-

OTHER KEY GLOBAL MARKETSRead

SOUTH AFRICA: The Alliance announced a new manufacturing project here in 2008 using the existing Nissan plant in Rosslyn, Pretoria which was established in the 1960s. Production of the Renault Sandero began in 2009, the first time that a Renault vehicle has been built in the country. With this manufacturing project, Renault and Nissan reaffirmed their commitment to South Africa, investing the equivalent of €80 million to increase production from 40,000 units a year to 68,000.

MEXICO: This country is a good example of how the Alliance synergies work. Ten years ago, the Renault Scénic was the first cross-manufacturing operation under the Renault-Nissan Alliance when production started at Nissan’s Cuernavaca plant in December 2000 (production ended in mid-2004). Nissan’s Aguascalientes plant began production of the Renault Clio in November 2001 and the Nissan Platina, derived from the Renault Clio sedan, in early 2002. Nissan has helped support Renault’s return to Mexico and Central America developing a dealer network and with a joint financing operation for customers.

BRAZIL: Renault has a 3.9 per cent share of this key market which has doubled over the last six years to around three million units. Renault is investing heavily (around €400 million between 2009 and 2012) in its Ayrton Senna plant in Curitiba which also produces models for Nissan including the Frontier, Xterra, and Aprio.

CHINA: The Alliance is principally represented by Nissan, which is continuing to build volume and market share with Dong Feng, its partner in the country since 2003. Nissan sold 755,518 vehicles in 2009 making China its second biggest market.

-

INTRODUCTIONRead

Synergy - the interaction of two or more organizations to produce a combined effect greater than the sum of their separate effects - is one of the most often heard words in the Alliance.

There are three ways the Alliance achieves its synergies:

• Cost reduction

• Cost avoidance

• New business opportunities (revenue generation)

It works - in 2009, the objective was to achieve €1.5 billion in synergies and the Alliance achieved €1.9 billion. Here’s how it was achieved...

-

2009 SYNERGIES IN DETAILRead

-

NEW BUSINESS OPPORTUNITIESRead

One of the strengths of the Alliance is that each partner brings its own expertise to the party which helps in such areas as the search for new business; this can be entering new markets like India or adding 4x4 technology (a Nissan strength) to other Alliance models or diesel engines (a Renault strength) to model line-ups for the first time.

Whatever the need or demand, the Alliance takes advantage of the industrial footprint of either partner to enter a new market or new technology while keeping the cost down.

The synergy target for 2010 is €2 billion of which half will come from new savings while RNPO, the Renault Nissan Purchasing Organization, is expected to contribute some €400 million.

-

SHARING COST AND KNOWLEDGERead

One of the earliest areas for Renault and Nissan to explore at the start of the Alliance was how best to share powertrains, something it now has extensive experience at and that generates large savings for both companies as a result. The target is to have the majority of models using Alliance powertrains rather than dedicated Nissan or Renault engines.

The two companies share design and development costs as well as intellectual property rights. The powertrain is therefore an Alliance powertrain belonging to both companies and not a Nissan or Renault powertrain.

What it doesn’t mean is having a joint Renault-Nissan team developing it because it would be less efficient than having Renault or Nissan developing for both. This is Alliance policy, but if specific competencies are requested people can be dispatched from either company to the development team.

-

GASOLINE AND DIESEL ENGINESRead

Generally, but not always, Renault will develop diesel engines, and Nissan will develop gasoline engines from 1.6-liters up. The aim is to reduce the overall cost - the entry ticket price - by sharing both design and development and creating volume to get economies of scale.

Good examples are

• the K9 engine (diesel, developed by Renault and widely used by Nissan especially for the Qashqai, Nissan’s bestseller in Europe). Qashqai lives up to its crossover positioning with a downsized engine leading to lower emissions thus avoiding tax penalties in some markets. Sourcing the engine from within the Alliance also helped keep the cost down so that Nissan could optimize pricing.

• the TL gearbox (manual transmission developed by Renault and used across the Alliance in engines up to 240 Nm)

• the H4M engine, a 1.6-liter gasoline unit developed by Nissan and to be used by Renault Samsung and in the Renault Fluence.

• the TCe 130, an Alliance-developed gasoline engine added to the Mégane line-up in the spring of 2009.

• The M9 (2.0 dCi, built in Cléon) used in the Renault and Nissan LCV and passenger car ranges.

-

COMMON NEEDSRead

The Alliance is always conscious that global markets have their differences while in the vehicle line-ups of Renault, Nissan, Infiniti, Renault Samsung and Dacia there will always be some specific engine needs for each brand, especially for the upper segments in the Nissan and Infiniti line-ups.

This diversity needs to be met at the same time as having a consistent approach to powertrain development across both companies. The challenge is to make sure common needs are identified as early as possible and brought together to reduce the requirement to diversify powertrains while still meeting the different needs of the individual brands and markets.

Infiniti is the latest beneficiary of this approach with the launch this year of diesel-engined models for Europe where refined, powerful diesels are vital for success in the premium market. Infiniti uses an adapted version of the Alliance V6 diesel engine (V9X dCi - built in Cléon, France) which was introduced on the Laguna Coupé at the 2008 Paris motor show. This engine is already fitted on the Laguna Coupé, Laguna sedan and Estate and used in different power outputs on other Nissan models

-

COMPONENTS SHARINGRead

The sharing of platforms or engineering architecture and the sharing of major components is a key element of the Alliance’s success.

The main driver of the Alliance strategy is the creation of high volumes for common parts to allow innovation in the parts manufacturing, aggressive cost reduction technology in modules and parts specification and the introduction of competitive technology.

The implementation of the Alliance strategy is based on:

• introducing the module concept for new models

• the application of common mechanical and electronic architecture

• a common engineering method for parts specification requirements

• common technical file for parts specification

-

V-PLATFORMRead

The new V-Platform, unveiled by Nissan at the 2009 Tokyo and 2010 Geneva motor shows, is the underpinning for the all-new Micra/March and a genuine breakthrough project, made possible because of the Alliance.

Instead of launching production in established markets like the U.S., Europe and Japan, Nissan instigated industry-leading measures to start production of a completely new model at overseas manufacturing sites such as India, China, Thailand and Mexico.

This meant developing an all-new production process to meet high quality levels, high levels of local sourcing and costs. The principal driving forces behind the decision for a new platform were:

• Growing customer needs for compact cars in emerging markets.

• The need for Nissan to strengthen its presence in this segment which occupies more than 20 per cent of the world market.

• Finding new and innovative ways to supply lower priced cars into the mature markets

But the V-platform also illustrates the synergies between the two companies. The Alliance involvement in this new platform is focused on sharing knowledge and best practices. The platform is being used for the new Micra being assembled at the new Alliance factory in Chennai.

For example, Renault has more knowledge of sourcing in India than Nissan. The Micra is also using Renault diesel engines and transmissions and on the gasoline engine, a Renault block.

The V stands for versatile - it is versatile enough to accommodate, without development or cost or any weight inefficiencies, customer requirements of all global markets whether RHD, LHD, diesel, gasoline, Euro 3 to 6, and all worldwide crash test requirements including the US, EU and Japan; it can also support both B and A segment cars. New vehicles will be developed and launched on the new V or existing B platforms depending on their characteristics. Initial work on the V-Platform started in 2005 and detailed engineering work began in Japan in 2007 in conjunction with global suppliers.

-

B-PLATFORMRead

An initial common platform (a Nissan-led project), the B-platform, has been used by Nissan since 2002 with the Micra (March in Japan) and Cube. This was followed in 2004 by the launch of the Tiida and Tiida Latio on the Japanese domestic market and the Nissan Note launched in January 2005. Tiida has subsequently gone on sale in selected global markets, including the U.S. where it is sold as the Versa. Four additional vehicles, the Nissan Wingroad (launched in November 2005), the Bluebird Sylphy (launched in December 2005), the Livina (launched from 2006 to 2008) and the NV200 light commercial vehicle (launched in 2009) are also based on the B-platform. Most recently, Nissan introduced the Juke. An innovative small crossover to be sold across the world, it further showed the flexibility and durability of this most successful Alliance platform.

In 2004, Renault unveiled the Modus, its first vehicle to use the common B-platform. In September 2005, Renault launched Clio III, also built on this platform. The common B-platform continues to bear fruit for the Alliance. In 2008, Nissan launched the new generation Cube compact.

The Dacia range (Logan, Sandero and Duster) is based on a derivative of the common B platform called the B0 platform.

-

C-PLATFORMRead

A second common platform (a Renault-led project), the C-platform, was launched by Renault in late 2002 for the production of its new Mégane II. In December 2004, the Lafesta, a new minivan, was launched in Japan as the first model from Nissan to adopt the common C-platform. Nissan launched the new Serena minivan in May 2005, and the new Sentra in October 2006 in the U.S, both based on this platform.

In 2007, the Nissan Qashqai, the X-Trail and Renault Samsung QM5 and Renault Koleos were launched also using the C-platform. From 2009, the renewed Renault Mégane, Scénic, the new Fluence and Renault Samsung SM3 further expanded the use of this platform.

-

COMMON PARTSRead

In a first step of the alliance synergies, Renault and Nissan have implemented until 2009 an approach enabling the exchange of components across platforms: the Interchangeable Components Policy (ICP).

ICP means using the same parts or fittings on different models, across several platforms and segments. In 2009 alone, almost €50 million worth of new synergies were created just by the extended use of more common components across the Alliance. These include air conditioning systems, struts and shock absorbers.

From 2009, a new step started for the implementation of common parts and synergy creation. A deep analysis of the Nissan and Renault engineering standards, parts specification and requirements was started under the leadership of Renault Nissan BV.

Over seven hundred items of technical policy, method, layout or performance requirement have been compared in order to make common Alliance standards for future vehicles engineering and development. Already, common technical files of parts, that simplify requests to suppliers and reduce development costs have been issued.

This common parts strategy is supported by a newly established organization including engineering and purchasing. Single Technical Leaders (STL) from Nissan or Renault are in charge of proposing global strategies for both companies , including technology breakthrough and sourcing schemes. They build the vision of the alliance diversity, the introduction of advanced technology for CO2 reduction or information technologies application, as well as the cost reduction plan with their engineering co-leader, and with the supplier account officers. Those strategies are approved by executive management of Nissan and Renault in regular Alliance Commodity Meetings (ACM).

This organization will ensure to realize strategy and associated savings. -

COMMON MODULE FAMILYRead

This is the new Alliance approach for communalization, or shared ownership of parts, which will lead to significant cost savings.

A module consists of a set of parts with a number of derivatives that can be applied to different models and powertrains. With a limited number of variations, the module can cover a large part of Renault and Nissan range.

This requires common mechanical and electronic architecture. Engine compartment, front-under body, rear-under body and cockpit are standardized to accept the same parts for different models. Similarly, the electronic network and control units can adopt the same structure while keeping different features on individual models.

Expanding the scope of common platforms by designing common parts and common modules that can be used for different platforms or segments, offers greater scope for vehicle and market differentiation.

It also contributes to improving cost efficiency, enhancing manufacturing flexibility and supporting global expansion while preserving the specific identity of each brand and features of each vehicle.

-

SAVINGS OF €110mRead

Major savings have been achieved over the past decade through logistics synergies. In 1999 this amounted to €25 million, by 2009 savings had doubled to more than €56 million and the target for 2010 is €110 million.

This ambitious - but achievable target - has been made possible by the decision last year to accelerate the convergence of Renault and Nissan’s logistics platforms including information systems and processes.

The formation of Alliance Logistics Europe (ALE), created in November 2009 and bringing together the Renault and Nissan logistics teams under a single director, is one good example of this acceleration - ALE is already delivering €50 million annual savings for the Alliance partners.

-

ALLIANCE LOGISTICS RUSSIARead

Early in 2010, ALR (Alliance Logistics Russia), a common Russia logistics organization, was formed and is expected to contribute significantly to ALE’s synergies.

ALE VP Colin MacDonald said: "Both Renault and Nissan face very similar challenges in Russia - both have CKD plants with ambitious parts localization programmes and both have new models planned for production at AvtoVAZ; all of this in a market with significant growth opportunities."

ALR brings together the inbound and outbound logistics for Renault, Nissan and Russian partner AvtoVAZ which makes vehicles under the Lada brand at Togliatti. It also coordinates the logistics for the new Nissan plant at St Petersburg, the existing Renault CKD operation in partnership with Avtoframos in Moscow as well as Togliatti where the Alliance plans to produce five different models for the three brands on the same line within two years.

ALR is starting work with local suppliers to help develop an efficient inbound supply chain and will also be responsible for distribution of finished vehicles. It will also work with the existing AvtoVAZ logistics organisation to help integrate the Alliance Production Way at the Togliatti plant.

-

SHARED EXPERIENCESRead

Combining logistics operations under the Alliance umbrella doesn't just produce economies of scale, there are also benefits by crossing the experiences of the teams which have different experiences and approaches but share the same goal: to deliver cars or parts on time, with quality and economic efficiency a priority.

Here are a few other highlights of the Alliance logistics operations:

• Sea shuttle: Since 2002, for vehicle transport, a sea shuttle between Santander (Spain) and Newcastle (UK), via Le Havre (France) and Zeebrugge (Belgium), has been transporting Renault vehicles from the plants in Spain and France northwards, and carrying Nissan vehicles manufactured in the Sunderland plant (UK) southwards.

• Global tender: Renault/Nissan organized a global tender driven by RNPO for vehicle maritime transportation. The main actions undertaken by the Alliance included alignment of specifications, route optimization and bundling between Renault and Nissan. This led to a 12 per cent cost reduction for the Alliance.

• Common standard packaging: The implementation of a common approach to the design of new packaging has reduced both costs and development times and has generated new opportunities for synergy through the consolidation of purchased volumes of future common packaging.

-

FIRST ALLIANCE JOINT VENTURERead

The Renault-Nissan Purchasing Organization (RNPO) was established in April 2001 as the first Alliance joint-venture company. Since 2003, RNPO is wholly owned by RNBV, the strategic management company which manages areas such as corporate governance, the exchange of ideas, builds strategy and helps leverage the maximum synergies between Renault and Nissan.

RNPO initially managed about 30% of Nissan's and Renault's global annual purchasing turnover. By November 1, 2006, this percentage had increased to 75% and was 92% by June 2008. From April 1, 2009, RNPO effectively accounted for 100% of all purchasing across the Alliance.

The geographical scope of RNPO has been extended to all the regions where Renault and Nissan have production activities in an effort to respond to worldwide needs.

As a joint Renault and Nissan procurement structure, RNPO helps to improve purchasing efficiency by using a global management system for purchases coming within the scope of the Alliance, while local purchasing departments work increasingly for both companies as a single purchasing organization.

One good example is media buying in Europe where Renault and Nissan, working with RNPO have chosen to deal with only one agency - Omnicom/OMD - covering 24 countries for Nissan and 30 countries for Renault. With a combined budget into several hundred million euros, the savings achieved have already been substantial.

-

COMMON SUPPLIER BASERead

Significant cost reductions in the Alliance have been achieved with joint purchasing and the building of a common supplier base. Since the beginning of the Alliance, the percentage of turnover of common Renault and Nissan suppliers grew from approximately 20% to more than 60%.

Most recently, in July this year, Renault and Nissan agreed to extend their co-operation with the Alliance's Russian partner AvtoVAZ as part of a broad plan to grow their combined business in Russia.

A key part of the programme is to create a network of local suppliers capable of supplying the partners with up-to-date, good quality parts at acceptable costs.

RNPO and the AvtoVAZ purchasing department have agreed to harmonize supplier quality and supplier development teams in Russia and unify them under a single operational management in order to achieve:

• Rapid improvement of the supplier base quality in Russia for mass production and new projects.

• Maximum synergy of resources and best practices.

• Internal procedures and methods improvement.

• One-voice position towards supplier base.

Following the creation of AvtoVAZ-Renault-Nissan Quality and Supplier Development (ARNQSD), work will be accelerated to increase the percentage of locally sourced parts.

ARNQSD is located in Togliatti with a satellite office in Moscow. Around 100 employees from the three companies are working for this new organisation.

-

CORE PROCESSESRead

The scope of RNPO is global, covering all geographical areas, in order to benefit from worldwide opportunities. Local Purchasing departments are progressively operating for both companies as a single purchasing organization in countries where both Renault and Nissan have industrial operations. These common organizations exist already in Mexico, Brazil, Argentina, India, Russia, South Africa and Morocco.

Key purchasing activities have been defined as core processes, common to all RNPO, Renault and Nissan purchasing departments, to reflect the best purchasing practices of the Alliance.

In February 2006, RNPO communicated to all suppliers the process named "Renault-Nissan Purchasing Way". This program details the values and processes promoted by the purchasing departments of the Alliance to optimize supplier performance. The Alliance has focused on collaboration with suppliers as business partners as essential for collective success.

-

ALLIANCE PRODUCTION WAYRead

The Alliance Production Way (APW) was introduced for the first time at the new Alliance Chennai plant in India. It is a manufacturing system and shop floor management common to Renault and Nissan and is the result of sharing best practices throughout the organization.

Under the APW, a flexible manufacturing process called Alliance Integrated Manufacturing System (AIMS) has been introduced. Its aim:

• To produce Renault and Nissan vehicles on the same line.

• To enable the line to handle four platforms and eight body styles in random production order.

The new Chennai plant was inaugurated earlier this year with the first Nissan Micra models, coming off the line in May. From 2011, the plant will start production of the Renault Koleos and Fluence. Renault is planning to bring out several new cars over the next one and a half to two years and will offer a complete range within four years. These vehicles will be manufactured at Chennai. The range will cover the key market segments and comprise both Renault models and cars built with the joint platforms of the Renault-Nissan Alliance.

The factory represents an investment of about €800 million over seven years from February 2008 to 2015 and will have the capacity to produce 400,000 vehicles a year at full ramp up. From start to finish the project took 21 months from ground breaking in June 2008.

-

SHARING BEST PRACTICESRead

In 2009, the Alliance created a dedicated structure (Alliance Industrial Sourcing) in charge of identifying the best Alliance plants for vehicle and powertrain industrial sourcing aimed at reducing total delivery costs, sharing assets (plants and platforms), minimize the entry ticket and open either partners to new market opportunities through cross manufacturing.

Another example of sharing best practice has been the implementation of Nissan's Intelligent Factory Automation (IFA) in Renault factories. This system consists in supplying line workers with supplies in a synchronized and automated way using robots wandering around the shop floor.

Manufacturing synergies

Increasingly, Renault and Nissan plants are building models for their Alliance partner:

• In South Africa, Nissan's Rosslyn plant builds the Nissan NP200 pickup (based on Logan pickup) and the Renault Sandero.

• In Brazil, Nissan utilizes Renault's Curitiba plant to produce the Frontier, Xterra and Aprio.

• Nissan's Barcelona plant produces the Primastar and the Renault Trafic.

• Nissan's Mexican plants located in Cuernavacas started production of Scénic in 2000 followed by Aguasclientes in 2001 with the Clio.. Nissan also produces the Platina (a Clio-based sedan) in Mexico.

• The Renault Samsung plant in Busan, Korea produces cars sold in Russia and the Middle East with a Nissan badge.

• The Renault Batilly plant builds Master II and Interstar (Nissan).

• The Chennai plant that currently produces the Nissan Micra will start producing Renault's Fluence and Koleos in 2011.

-

HOW A FAILED MERGER INSPIRED A SUCCESSFUL ALLIANCERead

Looking back on 11 years of the Alliance, Mouna Sepehri, Managing Director of the Alliance CEO Office, says: "We took a gamble in 1999, this has not been a takeover by one company of another. The partners are equal and if you look at the various mergers in the auto industry over the past few years the Alliance is the only one to have created value.

"It was a good decision. All mergers in the auto industry have failed, but the Alliance is different. We respect each other, respect each other's cultures."But the story of the Alliance starts well before 1999. According to Carlos Ghosn, Chairman and CEO of the Renault-Nissan Alliance, the success of the Alliance can be traced directly to the failure of the Renault-Volvo merger of 1993. At the last moment, Volvo - which was to own a minority (49 per cent) of the merged company - walked away from the deal, fearful for its loss of independence.

"Renault learnt a great deal from that failure," says Ghosn, who was to join Renault from tire maker Michelin three years later. "It learnt that mergers and acquisitions were perhaps not good business models. No company likes to lose its identity, its soul."

Bernard Rey, senior vice-president at Renault who also held executive positions at Nissan until March 2007, adds: "The intended Volvo merger was a disaster for us at the time. Top Volvo management were not supportive. They thought Renault was going to take control. In a way, it was probably a blessing. It prefaced many subsequent mergers and acquisitions and few, if any, have been successful."

The DaimlerChrysler merger of 1998, initially hailed as a success as it created the world's third largest automotive group, gave Renault further cause for concern. Renault was a relative motoring minnow, tiny alongside the big players. It was keenly seeking a partner to explore synergies and boost economies of scale.

"We had long wanted a relationship with a Japanese company," says Patrick Pélata, now chief operating officer for Renault but executive vice-president for product, strategic planning and programs for Renault from 2005 to 2008, who held a similar position at Nissan between 1999 and 2005. "We imagined it might be with a smaller company like Subaru. We couldn't imagine any big Japanese company would cooperate. My generation, who first went to Japan in the 1980s, discovered a huge gap in manufacturing capability. We were desperate to learn. But not surprisingly, the Japanese companies weren't telling us much."

-

STRUGGLING NISSAN SEEKS A PARTNERRead

Nissan, Japan's second largest car maker meanwhile was in trouble. The worst automotive victim of Japan's 'lost decade' of the '90s, Nissan had been unprofitable every year since 1992 (except for 1996), and had racked up more than $20 billion in debt. It had exhausted its resources to keep up with market leader Toyota. Its share of the global automotive market had fallen from 6.6 per cent in 1991, to 4.9 per cent in 1998. Its domestic market share had been in decline for 27 years in a row. It needed money, fast. At the time Nissan president Yoshikazu Hanawa was looking for an automotive partner prepared to give a substantial cash injection.

Two companies emerged as contenders: DaimlerChrysler, buoyed by initial positive feedback to its recent merger and keen for further expansion, and Renault, looking for an alliance with another car maker to give it greater economy of scale. DaimlerChrysler was a clear favorite.

"DaimlerChrysler was a much better known company in Japan and regarded as a more successful business, with more prestige," says Toshiyuki Shiga, chief operating officer for Nissan. "Renault was much smaller, and much less international - no presence in Japan or America, for instance, which were the markets Nissan knew best."

In March, 1999, however, DaimlerChrysler announced its withdrawal, deterred by Nissan's high level of debt. The way was left open for Renault, the sole suitor. Renault CEO at the time, Louis Schweitzer, wishing to increase Renault's small footprint in the world automotive industry, was determined to push ahead. He offered to purchase 36.8 per cent of Nissan's capital for $5 billion. The two companies would form an alliance. Uniquely, each partner would retain its identity and its independence.

"I was fully involved in negotiations," says Shiga. "Nissan management had a preference for Renault over DaimlerChrysler because Renault expressed clearly that they would treat Nissan as a partner. They spoke about an Alliance, to the benefit of both companies. They spoke about preserving corporate identities, brands, and separate managements. We liked what we heard.

"In September 1998, I visited Renault with Mr. Hanawa, our president. We saw Mr. Schweitzer. He asked us what Nissan's biggest weakness was. Hanawa-san told Mr. Schweitzer that a great weakness was our inability to implement cost reduction. Mr. Schweitzer mentioned that Carlos Ghosn was an expert at cost reduction.

"November that year was the first time I met Mr.Ghosn. He came to Nissan in Tokyo. Five Nissan directors attended the meeting, including myself and Hanawa-san. The potential deal was still secret, so not too many people were involved. Mr.Ghosn made a presentation on cost reduction. I was extremely impressed. He showed how he greatly reduced Renault's costs in Europe. The presentation was excellent - full of passion - and I thought wow, what a strong leader."

Louis Schweitzer did indeed ask Carlos Ghosn to go to Japan. If Ghosn refused, said Mr. Schweitzer, the deal was off. Carlos Ghosn accepted. The Alliance was underway.

On March 27, 1999, the agreement on the Alliance was signed by Louis Schweitzer and Yoshikazu Hanawa.

About 30 Renault executives were sent to Japan, to take up senior or influential positions in Nissan.

"When the Alliance started, Renault bought a share of Nissan because we needed the cash. That was our priority: cash. As it was a true Alliance, the intention was for Nissan to reciprocate and buy a stake in Renault, though this was not possible for a number of years. We simply did not have the funds." says Shiga. Later, Nissan bought a 15 per cent stake in Renault and Renault increased its stake in Nissan to 44.3 per cent.

-

RENAULT MANAGERS ATTEMPT TO UNDERSTAND NISSAN PROBLEMSRead

Key Renault executives, hand picked by Carlos Ghosn, arrived in Tokyo to supplement Nissan's management from April to July of 1999.

"Mr. Schweitzer, as much as possible, asked me to send our best people to work for Nissan," says Bernard Long, vice-president for senior executive staff management for Renault, who went to Japan in 1999 to help run Nissan's HR department. "We needed people with good listening skills, great talent for empathy with other people, open minded, straight, great level of integrity, who must speak English and preferably already had overseas experience. They had to have a clear ability to add value professionally. Some fields were priorities - corporate planning, product planning, purchasing, finance control."

Initially, the interchange of information and ideas that is at the heart of this successful Alliance was one-sided. Unquestionably, Renault gave more to Nissan, than vice versa.

Nissan, after all, was almost bankrupt. Big changes were necessary. "We knew we had to change," says Shiga. "We knew we needed help. This was well understood. The Japanese are very pragmatic people."

"Of course there were some concerns that we would not be treated as equals," says Itaru Koeda, currently honorary chairman of Nissan, and a key person in early Alliance negotiations. "Renault was not a big name in Japan. It was not regarded as a leading company. Yet we were confident Renault was the best prospect for Nissan, because of the partnership it offered. A key strength and source of confidence was the Alliance charter, signed in July 1999. The charter consists of three essential points. It respects the individual brands, it ensures that Renault and Nissan had individual responsibilities for their own companies, and it insisted that all decisions involving both companies were 'win-win' situations for both brands. Projects that might benefit the Alliance collectively but which would damage one of the brands were rejected. It must be win-win."

"Like some of my colleagues I went to Japan in April 1999," says Patrick Pélata. "We travelled the world to look at the Nissan network, from Mexico to Thailand, from Japan to England, every time asking Nissan people what was wrong, what do you think should be done? We wanted to really find out what Nissan people thought.

"The problems were identified by many of the Nissan people, namely the poor brand reputation, weak design, decision making on wrong criteria - too much on costs and not enough on revenue. Plus they were signing off cars that were not going to make money. They used the wrong metrics. There was also no proper product planning. The cars were engineering driven - sometimes engineering for engineering's sake - not customer driven. They did not identify customer wants, and try to meet them.

"The balance between commerce and engineering was just not right. They have to be equal - sales and marketing, product planning, engineering, design. Nissan was not good at customer research, at asking their customers what they wanted out of their cars, what they dreamt to do in their cars.

"They spent too much time looking at Toyota and Honda; they were obsessed by them, worried about them. They didn't go their own way.

"I became a Nissan person, we all did. We didn't work for Renault, though we knew they were a large shareholder, we worked for Nissan. Ninety-nine per cent of what I did was consensual. I didn't thump the table and tell my Nissan colleagues what to do. That never would have worked. I explained. Forming a consensus is part of Japanese management. That is exactly what we all tried to do. They are a very clever, very pragmatic people. They understood."

The product development teams changed. The European model, of a single program director responsible for the whole car - including, crucially, its ability to turn a profit - was introduced. Yet Nissan modified the European model by giving more power to the chief vehicle engineer, allowing the program director - though still responsible to the CEO for delivering the car - to concentrate more on the commercial side. This model has, in turn, been adopted by Renault.

-

JOINT TEAMS AND COMMITTEES HUNT FOR NEW OPPORTUNITIES AND GREATER SYNERGIESRead

Also reporting to the Alliance Board are RNBV and the small teams working in France and Japan that coordinate all alliance activities - including the work of the various Steering Committees (SCs), Cross Company Teams (CCTs), Functional Task Teams (FTTs) and Task Teams (TTs).

The Steering Committees, chaired by a member of Renault's or Nissan's executive committee, propose the priority subjects for the Alliance Board meetings, oversees the activities of the CCTs, FTTs and TTs, and help implement Alliance joint projects.

The key groups that explore new opportunities and synergies are the CCTs (Cross Company Teams). As the name implies, they are made up of employees of both companies. These teams are the crucial management tool that enables the individual strengths of Nissan and Renault to complement each other. They are also responsible for implementing action plans, assisted by the Steering Committees.

Employees will join a CCT for typically two to three years, and the composition of the teams will change, as new challenges arise. CCTs cover all the major areas of both companies. They include product planning, research and advanced engineering, vehicle engineering, powertrain engineering, manufacturing, purchasing, plus there are CCTs covering all sales regions and exploring greater synergies between the two companies. CCT members, working in Japan, France and at other Alliance facilities around the world, communicate daily with each other (typically by email), usually have weekly conference calls and normally meet, face to face, once a month. Team leaders report to the Alliance Board, with progress in their specific areas.

Functional Task Teams (FTTs) assist the work of the CCTs. Task Teams (TTs) help CCTs with specific assignments, and work on the task until it's accomplished.

When an opportunity or a problem arises, the FTT will study the CCT pilot for a project to either identify a new synergy or program or to solve an issue that the CCT cannot agree on.

If the issue cannot be solved at FTT level, it is referred to the appropriate Steering Committee. If that cannot be solved, it will go to the Alliance Board meeting.

This unique way of working encourages dialogue and cross company team work, and brings out the best in both cultures. It enables Renault to learn from Nissan, and Nissan from Renault. It encourages an Alliance team spirit. Yet it also respects the fundamental differences between the two independent companies.

-

ANOTHER ALLIANCE IS DISCUSSEDRead

As the need for even greater economies of scale within the global auto industry became ever more apparent, Renault and Nissan began exploratory talks with General Motors in July 2006 regarding the possibility of creating an industrial alliance. The talks were ended in October of that year without any agreement.

-

2010 - AND THE START OF ANOTHER CHAPTER IN THE ALLIANCE STORYRead

The Alliance took another step in 2010 by forming a strategic cooperation with Daimler (see Daimler section for full details). Projects include Renault and Daimler working together on next generation small cars: the Renault Twingo and smart fortwo, including electric versions as well as expanding both model ranges.

There will also be powertrain sharing and co-development on future projects across both passenger cars and light commercial vehicles. The two groups also announced an equity exchange that gives the Renault-Nissan Alliance a 3.1 per cent stake in Daimler and Daimler a combined 3.1 per cent in Renault and Nissan.

It is called a strategic cooperation because it is more than a cooperation agreement but not a full-blown alliance. It will be managed by RNBV for the Alliance and Daimler through a new cooperation committee giving representation to all parties.

Also in 2010, the Alliance confirmed its partnership with India's Bajaj Auto to develop a low-cost car, strengthened its relationship with Russia AvtoVAZ and started production at the first dedicated Alliance factory in Chennai, India (see section on International Growth).

-

1999Read

March 27 Louis Schweitzer and Yoshikazu Hanawa sign the Alliance agreement between Renault and Nissan in Tokyo.

May 28 Closing date of the agreement: Renault takes a 36.8% equity stake in Nissan Motor, a 15.2% equity stake in Nissan Diesel and acquires Nissan's five financial subsidiaries in Europe.

June 9 The first informal meeting of the Global Alliance Committee (GAC), governing body of the Renault-Nissan Alliance, takes place in Paris, followed by monthly meetings alternately in Paris and Tokyo.

June 25 The Nissan Annual Shareholders' Meeting is informed of the Alliance with Renault. Carlos Ghosn (Chief Operating Officer), Patrick Pélata, Product Planning and Corporate Strategy) and Thierry Moulonguet (Senior Vice-President, Deputy Chief Financial Officer) join the Nissan Board of Directors.

July 6 Renault takes a 22.5% stake in Nissan Diesel while Nissan keeps a 22.5% stake in Nissan Diesel in accordance with the terms of the agreement of March 27.

October 18 Carlos Ghosn announces the Nissan Revival Plan (NRP) in Tokyo.

December 9 Renault and Nissan announce Renault's return to Mexico with the backing of Nissan's manufacturing capacity and sales teams.

-

2000Read

January Renault Mexico is established with Nissan's support.

April 25 Renault announces its project to reinforce its presence in Japan with the support of Nissan.

May 24 First Alliance Convention, held in Paris.

May 29 Nissan announces plans to develop its presence in Mercosur with Renault's support.

June 20 Carlos Ghosn is named President and COO of Nissan.

September - Renault buys 80.1% share in Samsung Motors of South Korea. Samsung has a 19.9% share. The company builds cars based on Nissan technology.

October Nissan do Brasil Automoveis is established with existing Renault dealers' support.

November 15 Renault announces its return to Australia with Nissan's support.

November 21 Nissan Motor and Nissan Diesel announce they will supply diesel engines (ZD) to Renault and Renault V.I. from 2003.

December 6 Production of the Scénic at the Nissan Cuernavaca Plant in Mexico begins, representing the first joint-production operation of the Alliance.

December 19 Agreement between Renault and Yulon Motor, Nissan's partner, to give new impetus to Renault's presence in Taiwan.

-

2001Read

February 17 Work starts on a new joint Alliance C-platform

March 6 Decision to sell the new X83 compact van in Europe with the Nissan badge as from mid-2002 and to produce it in Nissan's Barcelona factory from end of 2002.

April 2 Renault-Nissan Purchasing Organization (RNPO), a joint purchasing company, is established.

May 2 Opening of the first Renault showroom in Australia thanks to Nissan's support.

June 13 Renault and Nissan define new projects on the Indonesian market.

June 21 Carlos Ghosn is named President and Chief Executive Officer of Nissan.

July 21 Sales of Renault vehicles in Taiwan with Nissan's local partner begin.

September Sales of the Renault Kangoo 4x4 fitted with a Nissan 4WD unit begin.

September 13 Renault and Nissan set up a common IS/IT organization Renault Nissan IS/IT Office (RNIO).

October 29 Second Alliance Convention, this time in Tokyo.

October 30 Renault and Nissan announce a new step in the development of the Alliance. Renault is to increase its stake in Nissan to 44.3% while Nissan will take a 15% stake in Renault. Renault-Nissan bv is to be established under Dutch law to steer Alliance strategy in the medium and long term.

November 15 Production of the Renault Clio at the Nissan Aguascalientes plant in Mexico begins.

December 20 Renault and Nissan inaugurate an LCV plant for the production of the Renault Master van, the first model made at the LCV plant in Curitiba, Brazil. This plant represents the Alliance's first new joint industrial site.

December 20 Closing date of the agreement announced on October 30. Signature of the "Alliance Master Agreement."

-

2002Read

January Renault 160Nm manual transmission (JH) is used on Micra; Renault 200Nm manual transmission (JR) is used on Almera.

February Production of Nissan ND manual transmission begins at the Renault Cacia plant in Portugal. It is for Nissan models (Primera, Almera, Almera Tino) built at Nissan Motor Manufacturing (UK) Ltd. and Nissan Motor Iberica S.A. and for the Renault Mégane II.

March Sales of the Nissan Interstar in Europe, a double-badged vehicle with the Renault Master, begin.

March Renault and Nissan adopt the Alliance Quality Charter.

March 1 Renault increases its stake in Nissan to 44.3% for a total investment of ¥215.9 billion (€1.85 billion / $1.62 billion).

March 4 Production of the Nissan Platina, derived from the Clio sedan, begins at the Nissan Aguascalientes plant in Mexico.

March 5 Sales of the Nissan March in Japan, the first vehicle built on the common B platform, begin.

March 8 Sales of the Renault Vel Satis, powered by a Nissan 3.5-liter V6 gasoline engine (VQ35), begin.

March 14 PSA Peugeot-Citroën, Ford and the Renault-Nissan Alliance establish a European joint venture in automotive telematics.

March 28 Renault and Nissan establish a common strategic management structure, Renault-Nissan bv.

March 29 Nissan acquires a 13.5% stake in Renault for a total investment of €1.9 billion.

April 2 Nissan launches its NISSAN 180 plan.

April 22 Production of the Nissan Frontier pickup, the second model produced at the LCV plant in Curitiba, Brazil, begins.

April 26 Carlos Ghosn joins the Renault Board of Directors.

May 28 Nissan increases its stake in Renault to 15%.

May 29 The Alliance Board, replacing the Global Alliance Committee (GAC), meets for the first time.

June 28 Renault and Nissan agree to increase the scope of common purchasing via RNPO from $15 billion to $21 billion.

July 1 Renault-Nissan Information Services (RNIS) is established.

September Sales of Renault Mégane II in Europe, the first vehicle built on the common C platform, begin.

September Sales of the second Renault Samsung Motors model, the SM3, with the technical support from Nissan, begin in South Korea.

September 2 Nissan and Toyota announce a partnership in hybrid vehicles

October Nissan V6 3.5 L engine (VQ35) is used on the Renault Espace IV.

October 22 Production of the X83 compact van begins at the Nissan Barcelona plant in Spain - the first cross-manufacturing project in Europe (sold as the Renault Trafic, Nissan Primastar and Opel/Vauxhall Vivaro).

November Establishment of the Global Alliance Logistics Committee (GALC) and of the Alliance Logistics Taskforce (ALT).

November 28 Nissan launches Micra production at NMUK in Sunderland.

December Renault 1.9 dCi engine (F9Q) is used on the Nissan Primera.

December Sales of the Nissan Almera in Europe, fitted with the Renault 1.5-liter diesel engine, begin.

-

2003Read

January Renault 200Nm manual transmission (JR) is used on Micra. The Alliance Vehicle Evaluation System (AVES) is applied in all Renault and Nissan plants.

January Creation of an Incidentology Joint Team regarding Quality on Powertrain.

January Renault 1.5 dCi engine (K9K) is used on the Nissan Micra.

January 23 Sales of the new Nissan Micra, the European version of the Japanese March based on the common B platform, begin.

March Sales of the Nissan Primera in Europe, fitted with the Renault 1.9-liter diesel engine, begin.

March Common standard packaging established in Europe.

March 26 Production of the Nissan Xterra, the third model produced at the LCV plant in Curitiba, Brazil, begins.

April Sales of the new Nissan Micra in Europe fitted with the Renault 1.5-liter diesel engine begin, completing the new common-rail diesel engine line-up for the European market.

April In the field of logistics, common Key Process Indicators (KPI) and Knocked Down (KD) evaluation system are established.

May Establishment of a common working group to improve supply parts management for logistics.

May 15 Signature of a memorandum agreement between Renault and TCEC, a subsidiary of Nissan's Malaysian partner in Malaysia.

June Renault and Nissan announce the creation of a common regional parts warehouse in Hungary, which will cover activities of both groups in Central Europe as of mid-2005.

July Decision by the Renault-Nissan Alliance Board to enlarge the scope of joint purchasing by Renault-Nissan Purchasing Organization from 43% to 70% of the Alliance purchasing turnover ($21.5 billion to $33 billion per year).

October Sales of the Nissan Kubistar in Europe, a double-badged vehicle with the Renault Kangoo, begin.

October 1 The Renault-Nissan Alliance Board agrees to enlarge the scope of joint purchasing by Renault Nissan Purchasing Organization (RNPO), from the current annual volume of $21.5 billion to $33 billion, or 43% to 70% of the Alliance purchasing turnover

November 27 Renault reduces its stake in Nissan Diesel from 22.5% to 17.9%, while Nissan's stake increases from 22.5%to 23.9%.

December 7 The Alliance Worldwide Backbone (AWB) broadband network, the new high-level network infrastructure of the Alliance, is operational.

-

2004Read

January RNPO Phase III, enlarging the scope of its activities from approx. 43% to 70% of the Alliance turnover (from $21.5 to $33 billion/year) and its geographic responsibilities, begins.

January In Mexico, a new common financing program for Renault and Nissan customers and dealers begins.

March 29 Alliance "Vision - Destination" is announced for the fifth anniversary of the Alliance.

May 19 Unveiling of a new model, Renault Modus, the first Renault model to use the common B platform. It will be marketed mainly in Europe from September of this year.

June Sales of the Renault Master, fitted with the Nissan 3.0-liter diesel engine, begin in Europe.

August 31 Nissan announces the development of 1.5-liter HR gasoline engine (HR15DE/S2G) and 2.0-liter MR gasoline engine (MR20DE/M1G), the first Alliance co-developed engine series.

September Sales of the Renault Modus, Renault's first vehicle built on the common B platform, begin in Europe.

September Sales of the Logan, marketed under both Renault and Dacia brands, begin in Romania. The Logan is based on a derivative of the common B platform.

September 30 Sales of the Nissan Tiida, based on the common B platform, fitted with the common HR15DE (S2G) engine and first Alliance co-developed navigation and communication system, begin in Japan.

October 29 Sales of the Nissan Tiida Latio, based on the common B platform and fitted with the common HR15DE (S2G) engine, begin in Japan.

December Sales of the third Renault Samsung Motors model, the SM7, with the technical support of Nissan, begin in South Korea.

December 2 Sales of the Nissan Lafesta, based on the common C platform and fitted with the common MR20DE (M1G) engine, begin in Japan. The Lafesta becomes Nissan's first model to adapt the common C platform.

December 15 Renault Kangoo CKD assembly in Malaysia begins with the support of Nissan's local partner.

-

2005Read

January 11 Additional sales of Nissan Tiida and Tiida Latio with the common MR18DE (M1G) 1.8L engine, begin in Japan.

January 20 Sales of the Nissan Note, based on the common B platform and fitted with the common HR15DE (S2G) engine, begin in Japan.

January 25 Sales of the Renault Samsung Motors model, the new SM5, with the technical support of Nissan, begin in South Korea.

February 21 First European application of the new Alliance co-developed navigation and communication system (on the new Renault Laguna and the Nissan Pathfinder) is announced

March 1 First common 6-speed manual transmission (MT1) on Renault Modus displayed at the Geneva Motor Show.

March 8 Renault sells all of its 17.9% stake in Nissan Diesel.

April 4 Sales of Renault Modus, the first vehicle fitted with common 6-speed manual transmission (MT1), based on the common B platform, begin.

April 21 Last Alliance Board Meeting for Louis Schweitzer is held.

April 25 Nissan launches its NISSAN Value-Up business plan.

April 29 Carlos Ghosn is appointed President and CEO of Renault. Louis Schweitzer is appointed Chairman of the Board of Renault.

May 31 Sales of Nissan Serena, based on the common C platform and fitted with the common MR20DE (M1G) engine, begin in Japan.

June 1 Renault and Nissan hold an opening ceremony for a joint parts warehouse in Hungary (established in April 2005).

September 16 Sales of Renault Clio, based on the common B platform and fitted with the common 6-speed manual transmission (MT1), begin.

October Sales of the new Renault Laguna II, fitted with the common M9R (M1D) engine, begin in France.

October 18 Third Alliance Convention in Tokyo.

November 14 Launch of the new Nissan Wingroad, based on the common B platform and fitted with the M1G engine (MR15DE and MR18DE).

November 24 Sales of the Renault Samsung Motors-built sedan SM3 globally under Nissan badge is announced.

December 19 Sales of new Renault Mégane II, equipped with the co-developed M1D 2.0 l diesel engine and based on the Alliance C platform, begin.

December 21 Launch of the new Nissan Bluebird Sylphy, based on the common B platform.

-

2006Read

January Renault-Nissan Alliance sells a combined 6,129,254 vehicles in 2005, up 6.0 percent over 2004, a global market share of 9.8 percent, the fourth largest global automotive group.

February 7 Exports of Renault Samsung Motors-built sedan SM3 begin to Russia and the Middle East under the Nissan badge

February 9 Renault Commitment 2009 plan is announced.

March 22 Renault unveils new Alliance diesel engine, developed by Renault, the 2.0dCi. It will be used initially in Megane, Laguna, Espace and Vel Satis models. Nissan vehicles fitted with the engine will be released later.

March 27 Nissan reduces its stake in Nissan Diesel from 18.9% to 5.9%.

July 15 Renault, Nissan and General Motors begin exploratory talks regarding the possibility of creating an industrial alliance.

September 26 Fourth Alliance Convention in Paris.

September28 Nissan sells its entire stake in Nissan Diesel to AB Volvo.

October 5 Renault, Nissan and General Motors terminate discussions regarding a proposed alliance among the three companies.

December 22 Renault and Nissan announce that they are working together on lithium-ion battery technology and packaging, the electric motor and the software that is needed to manage the solution.

-

2007Read

January 30 Renault-Nissan Alliance announces more than 5.9 million vehicle sales in 2006.

April - The Alliance announces that its electric vehicles will be powered by advanced compact lithium-ion batteries sourced from Nissan-NEC joint venture company, AESC (Automotive Energy Supply Corporation),

July 13 Nissan begin sales of the Nissan Aprio, a subcompact car for the Mexican market, built in the Renault passenger car plant in Brazil.

September 1 The Kingdom of Morocco and the Alliance sign a Memorandum of Understanding to develop a new manufacturing complex in Tangier.

September 6 Renault-Nissan Alliance announces plans to create new technology and business centre in India.

November 19 Renault Samsung launches QM5 in Korea.

November 22 Renault announces production of Sandero in Nissan South Africa plant from 2009

December 17 Renault and AvtoVAZ announces the agreement on strategic partnership in Russia

-

2008Read

January 18 The Kingdom of Morocco and the Alliance sign the final agreements for the industrial complex in Tangiers.

January 21 The Alliance and Project Better Place sign MOU for an electric vehicle project in Israel.

January 30 The Alliance announces record sales of 6.16 million vehicles in 2007.

February 22 MOU to build first Alliance factory in Chennai is announced by the Alliance and Government of Tamil Nadu, India.March 27 Renault-Nissan and Project Better Place pursue their strategy of zero-emission vehicles in Denmark.

April 1 RNPO expands its scope and covers 90% of the Alliance purchasing turnover.

May 19 Start of operations at Automotive Energy Supply Corporation (AESC), a joint venture between Nissan and NEC, to produce lithium-ion batteries for the Alliance as well as Project Better Place and other customers.

June 6 Groundbreaking for new Alliance factory in Chennai, India.

June 17 Fifth Alliance Convention in Tokyo and first Alliance Award Ceremony held.

July 17 The Alliance announces investment of 1 billion rand (€80 million ) in a new manufacturing project in South Africa.

July 22 The Alliance and the state of Tennessee form zero-emission vehicle partnership.

August 22 Nissan announces plans to produce Livina, Grand Livina in Brazil and Renault announces plans to produce Sandero Stepway there.

-

2009Read

April 6 The Alliance signs agreement with the Irish government to supply EVs within two years; Dublin wants EVs to account for 10% of all new-vehicle sales.

April 23 Renault announces that it will begin making a new turbocharged 1.6-litre diesel engine for the Alliance at its plant in Cleon, France, in 2011.

May 11 The Singapore government signs a MOU with the Alliance to study the development of a recharging infrastructure and ways to promote sales of electric vehicles that would be marketed by Renault and Nissan.

May 29 Formation of an Alliance dedicated team to foster deeper, broader cooperation and to maximize the contribution of synergies to the performance of both partners.

June 1 The Alliance announces plans to implement a further €1.5 billion in savings during the fiscal year ending March 2010 through greater sharing of manufacturing, logistics, powertrains, platforms and components.

July - Renault Samsung Motors launches new Renault-based SM3 model.

July 21 The UK and Portugal are chosen as two sites in Europe to produce lithium-ion batteries for the Alliance.

August 2 Nissan unveils the LEAF. Slated for launch in late 2010 in Japan, the US, and Europe, Nissan LEAF ushers in a new era of mobility - the zero-emission era. It will be manufactured at Oppama, Japan, with additional capacity planned for Smyrna, Tennessee from late 2012. Lithium-ion batteries are being produced in Zama, Japan.

October 12 A further investment by the Alliance in Russia's AvtoVAZ is announced with the aim of boosting production of cars based on the Logan platform to 300,000 units by 2015.

October 30 Construction starts of the Alliance plant in Tangiers, Morocco. The plant, which will produce B0 platform vehicles (Logan), will house stamping, welding and paint shops, a general assembly line, and a logistics shipment centre and will be operational in early 2012 with an output capacity of 170,000 vehicles a year. In the long term, capacity may be increased to 400,000 vehicles a year.

November 1 - The Alliance confirms that the Nissan LEAF will be built at the Smyrna, Tennessee plant from late 2012; lithium-ion battery packs will also be assembled there.